Hays County Property Tax Rate 2024

Hays County Property Tax Rate 2024. Property tax amount = ( tax rate ) x ( taxable value of property ) / 100. The tax rate (below) is per $100 of home value, as determined by the hays county appraisal district.

The median property tax (also known as real estate tax) in hays county is $3,417.00 per year, based on a median home value of $173,300.00 and a median effective. The hays central appraisal district handles the following:

Appraised Value And The Tax Rate.

Property tax amount = ( tax rate ) x ( taxable value of property ) / 100.

The Office Also Collects Fees For Title And Registration.

View, print, or pay your taxes online.

Hays County’s Fiscal 2024 Budget Of $389.9 Million.

Images References :

Source: propertytaxloan.com

Source: propertytaxloan.com

Property Tax Loan in Hays County Ovation Lending, 2022 tax rates & exemptions. 2023 tax rates & exemptions.

Source: grainofsound.org

Source: grainofsound.org

Hays Central Appraisal District BIS Consulting Simplificando la TI, Hays county commissioners decreased the tax rate by 8% for fy22, but that rate drop still means increased taxes on homeowners as home values continue to rise. Appraisal district appraisers are not the tax collector, and have nothing to do with the total amount of taxes assessed.

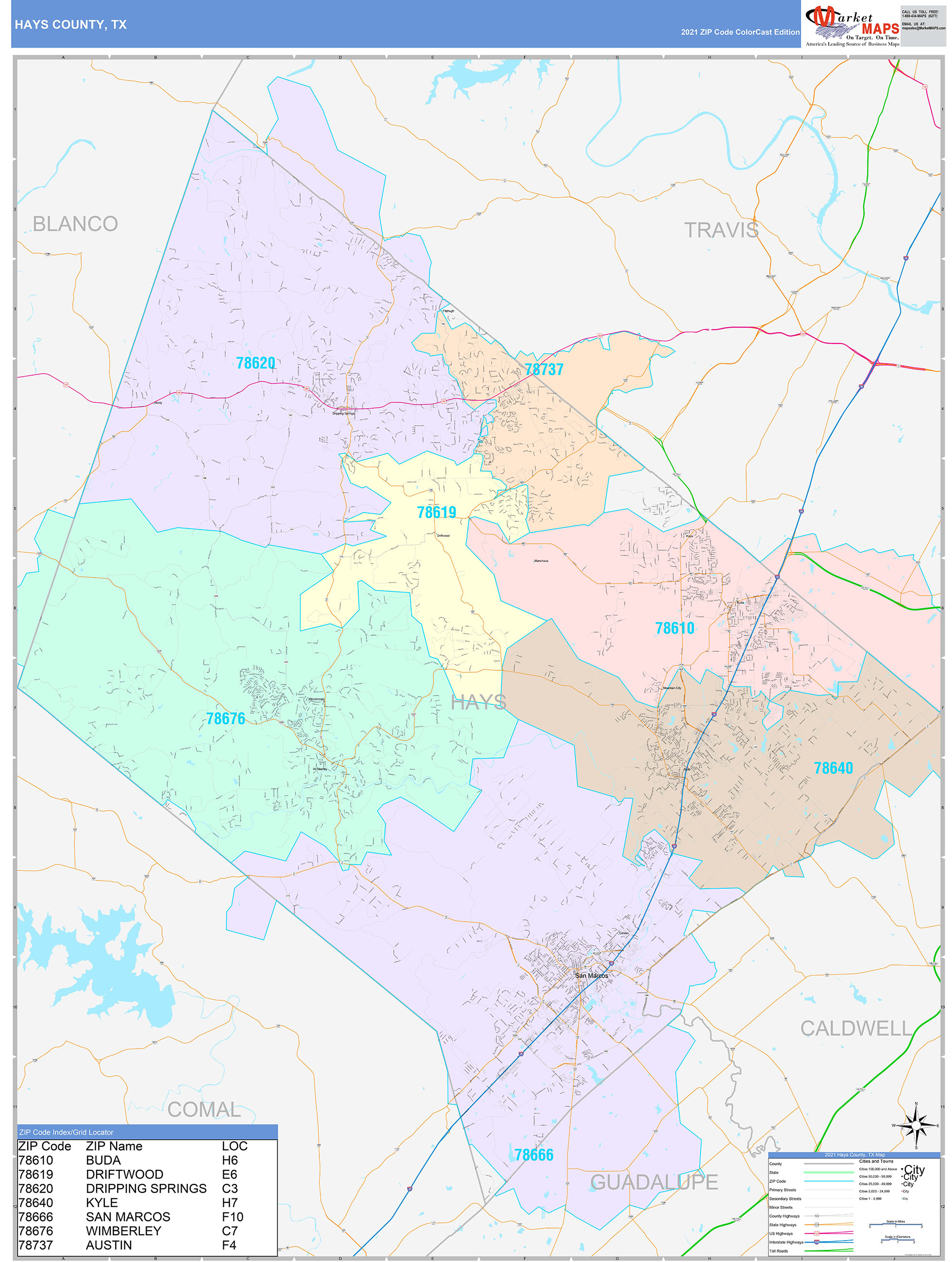

Source: www.mapsales.com

Source: www.mapsales.com

Hays County, TX Wall Map Color Cast Style by MarketMAPS, Hays county homeowners pay median property taxes of more than $3,400 per year on. The office also collects fees for title and registration.

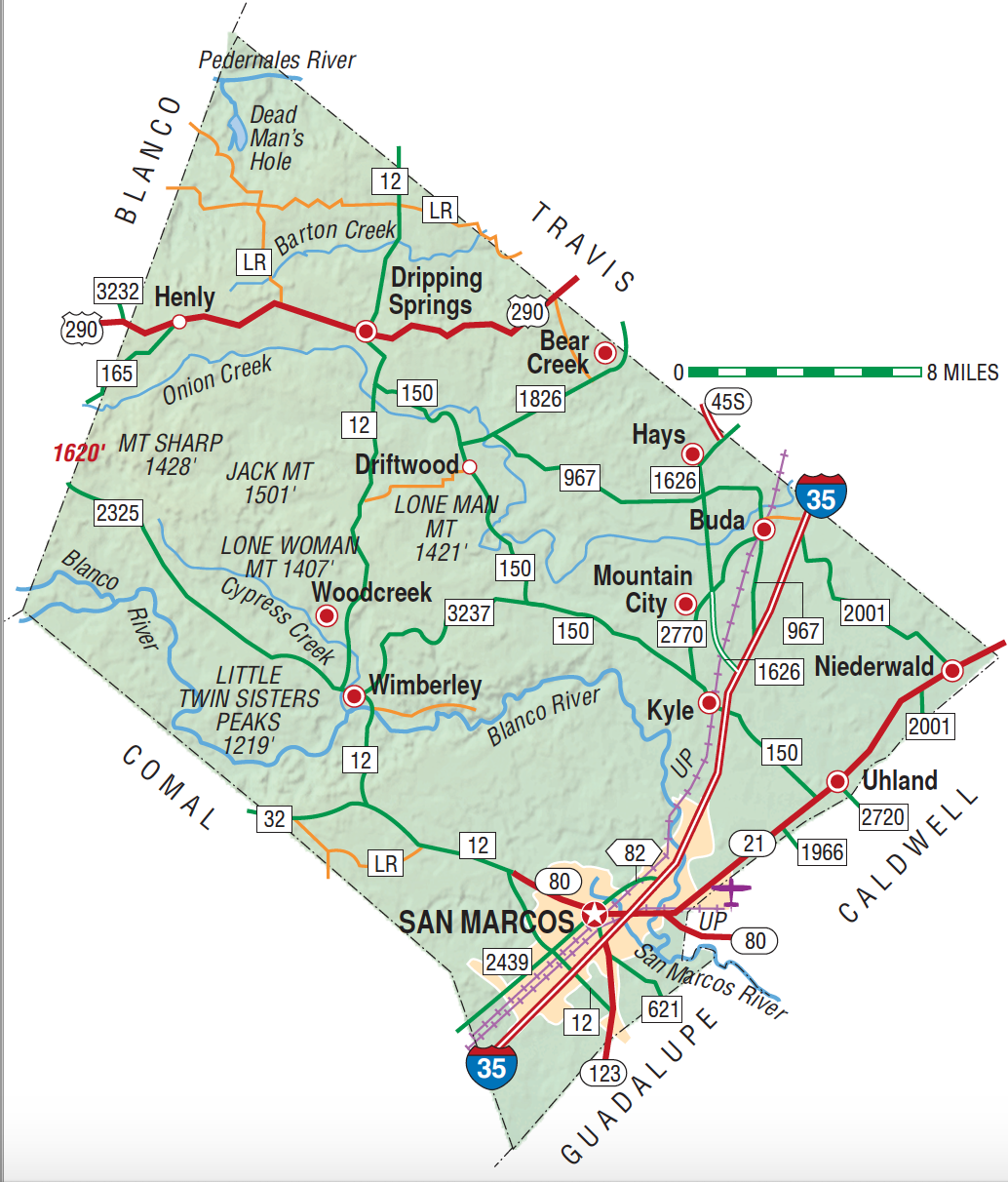

Source: www.texasalmanac.com

Source: www.texasalmanac.com

Hays County TX Almanac, Tax rates for 2024 have been reported on the department of local government finance’s website, in the county budget orders. The office also collects fees for titles and registration of motor vehicles within the.

Source: www.hechtgroup.com

Source: www.hechtgroup.com

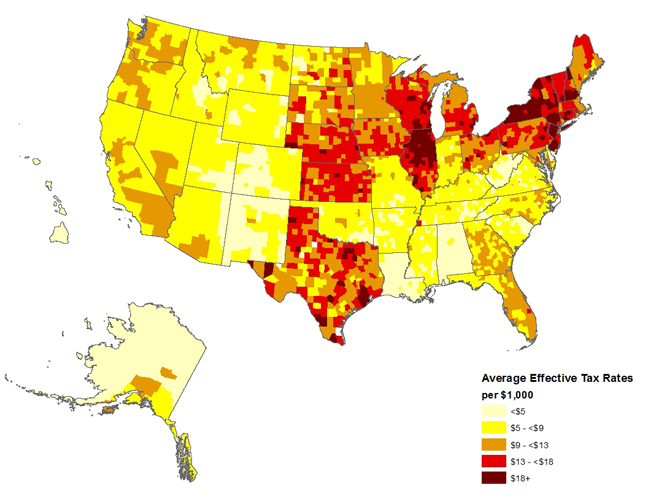

Hecht Group Where To Pay Hays County Property Taxes, Each county has its own property tax rate in addition to other taxing entities within those areas, and these rates change every year in response to budget needs. The median texas property tax is $2,275.00, with exact property tax rates varying by location and county.

Source: texascountygisdata.com

Source: texascountygisdata.com

Hays County GIS Shapefile and Property Data Texas County GIS Data, New and updated property tax information has been compiled by hays central appraisal district and is available now to assist taxpayers. The office also collects fees for titles and registration of motor vehicles within the.

Source: hayscountytx.com

Source: hayscountytx.com

Home Hays County, View, print, or pay your taxes online. This property tax information is current and covers a wide range of topics, such as taxpayer remedies, exemptions and appraisals,.

Source: knowyourtaxes.org

Source: knowyourtaxes.org

Hays County » Know Your Taxes, A love of public service. The hays central appraisal district handles the following:

Source: mungfali.com

Source: mungfali.com

Dallas County Constable Precinct Map, Explore how hays imposes its real property taxes with this comprehensive guide. Each county has its own property tax rate in addition to other taxing entities within those areas, and these rates change every year in response to budget needs.

Source: www.okhba.org

Source: www.okhba.org

NAHB Now Property tax rates vary across and within counties OkHBA, Appraised value and the tax rate. 2020 tax rates & exemptions.

Values Displayed Are 2023 Certified Values.

Gill, denson & company represents hundreds of hays county property owners each year during the tax protest season.

Appraised Value And The Tax Rate.

Determining taxable properties, their value and the taxable.